LARCO: Future Trends in World Nickel Production and Consumption

These last years, the huge increase in nickel (Ni) demand resulted in an enormous increase in its production which exceeded 3.000.000 t. Asia is now a major player in nickel production and consumption. One of the reasons for the increased demand of nickel is the need for more batteries: Several countries promote the production and use of electric vehicles to achieve carbon neutrality. Today, available data indicate that in several regions, including the European Union, current production capacity and primary reserves of nickel cannot meet the growing nickel demand.

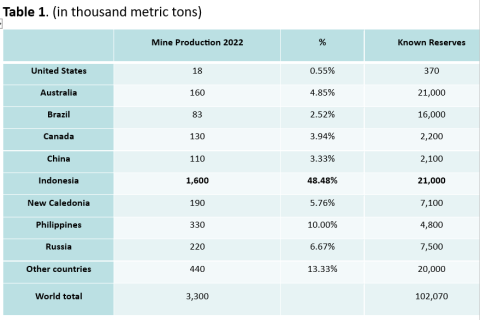

Table 1 shows the world mine production of nickel for the year 2022 and the estimated reserves according to USGS (Unites States Geological Survey) report (Nickel Statistics and Information, 2023). The data shows that the biggest mine production takes place in Indonesia.

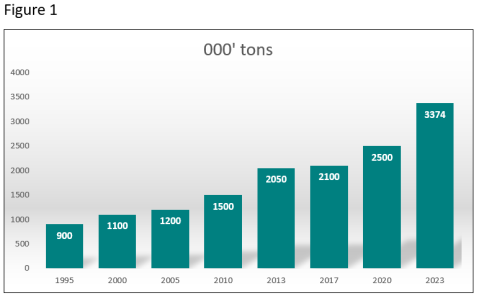

Figure 1 shows the world primary nickel production in thousand tons for a period of 30 years. It is seen from this data that the world primary nickel production increased sharply over the period 2009 to 2013. Then an apparent increase was witnessed for the period 2017-2020 before the disruptions caused by the COVID19 pandemic in 2020. The International Nickel Study Group (INSG) forecasts nickel pig iron (NPI) production in Indonesia to continue to rise, with a further decline in China. Also in Indonesia, the conversion of NPI to nickel matte is growing, high pressure acid leaching (HPAL) plants to produce mixed hydroxide precipitate (MHP) are continuing to ramp up output, and the first nickel sulphate project was commissioned in March of 2023.

In the European Union, Greece was until recently the only ferronickel (FeNi) producer in the European Union. On average, approximately 95.000 t of granulated FeNi with 20 percent average nickel content was produced annually by the GMMSA LARCO from domestic nickeliferous laterite ore deposits. Figure 2 shows the smelting plant of GMMSA LARCO in Greece.

Socio-economic data on nickel production and consumption indicates its importance throughout its entire nickel value chain, from mining through end use and recycling. Nickel has a high added value and plays an important role in employment in many countries and industrial sectors. In Europe, a socio-economic assessment indicates that the total value added by the nickel industry and its value chains is estimated to be 43 billion Euro. In addition, the output generated by nickel and related industries is around 130 billion Euro, involving around 750.000 direct or indirect jobs (reference year 2017). Nickel is one of the metals that contributes to sustainability.

In conclusion, Nickel is a strategic metal and its demand is expected to increase significantly in the following years. The end of the COVID-19 pandemic, the anticipated end of the Russian-Ukrainian conflict and its increased demand for batteries are factors that are expected to drive the high mine and refinery production in the following years.

Image source: LARCO